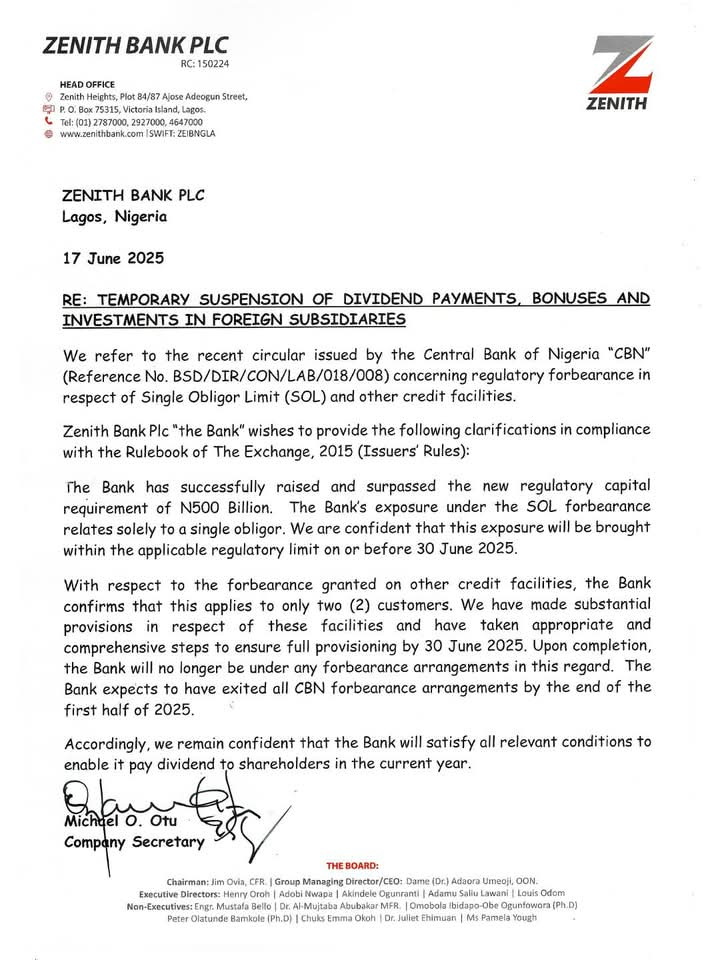

Zenith Bank Plc has assured its customers and shareholders of its strong financial position following the Central Bank of Nigeria’s (CBN) recent circular on regulatory forbearance regarding Single Obligor Limit (SOL) and other credit facilities.

In a statement issued by the Company Secretary, Mr. Michael O. Otu, the bank explained that while it is currently under temporary regulatory forbearance by the CBN, there is no cause for alarm.

The Bank confirmed it has successfully surpassed the new regulatory capital requirement of ₦500 billion, thereby reinforcing its financial strength.

The bank clarified that the SOL forbearance granted by the CBN pertains to a single obligor only. Zenith Bank expressed confidence that this exposure will be reduced to comply with regulatory limits before the deadline of June 30, 2025.

Regarding the forbearance on other credit facilities, the Bank stated that it involves just two customers. It has already made significant provisions for these facilities and has taken appropriate steps to ensure full provisioning by the same June 2025 deadline.

Following these measures, the bank expects to exit all forbearance arrangements by the end of the first half of 2025.

Zenith Bank further explained that the current temporary suspension of dividend payments, bonuses, and investments in foreign subsidiaries is a compliance measure as part of the forbearance process.

However, it emphasized that it anticipates satisfying all necessary conditions to resume dividend payments to shareholders before the end of the current financial year.

The statement was made in accordance with the Rulebook of The Exchange, 2015 (Issuers’ Rules), to keep investors and the general public properly informed.

Customers and shareholders are encouraged to remain confident in the bank’s robust risk management framework and commitment to regulatory compliance.